“Over the years we’ve invested significantly in our field data team - focusing on producing trusted ratings. While this ensures the accuracy of our Ratings, it doesn’t allow the scale across the thousands of projects that buyers are considering.”

For more information on carbon credit procurement trends, read our "Key Takeaways for 2025" article. We share five, data-backed tips to improve your procurement strategy.

One more thing: Connect to Supply customers also get access to the rest of Sylvera's tools. That means you can easily see project ratings and evaluate an individual project's strengths, procure quality carbon credits, and even monitor project activity (particularly if you’ve invested at the pre-issuance stage.)

Book a free demo of Sylvera to see our platform's procurement and reporting features in action.

With carbon offset claims frequently criticized as ‘greenwashing’, organizations are rightly concerned about how to properly evaluate the credits they buy.

At Sylvera, we consider four key concerns when rating carbon credits: carbon performance, additionality, co-benefits, and permanence.

The latter concern is what we’ll address in this article. Read on to find out what permanence means for carbon credits, how offsetting projects ensure permanence, and how organizations can evaluate permanence claims when purchasing carbon offsets.

What is permanence in relation to carbon credits?

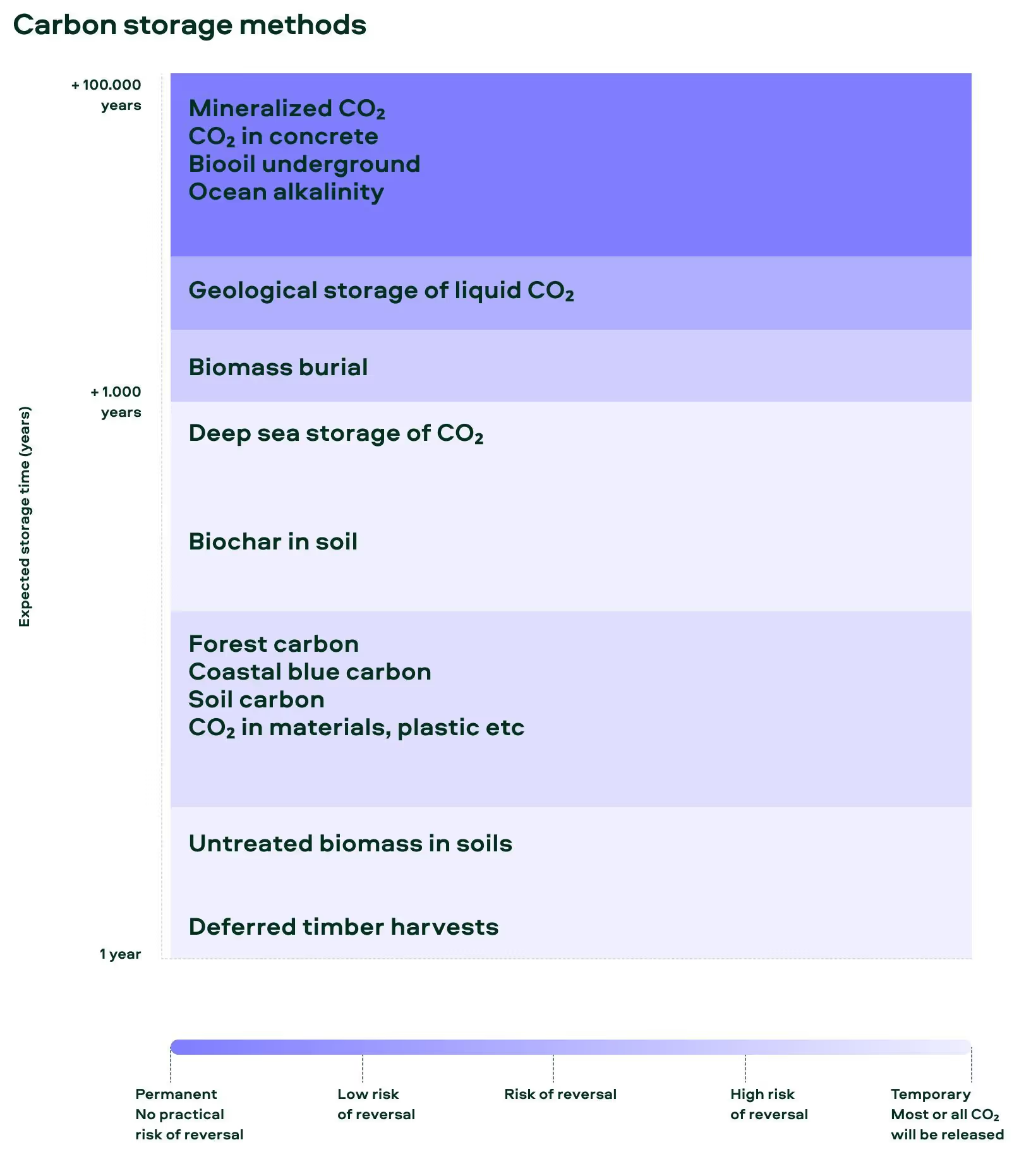

When we talk about the permanence of carbon offsets, we’re talking about how long the carbon dioxide removed or avoided will be kept out of the atmosphere.

Specifically, when we evaluate credits based on permanence, we’re talking about the degree of confidence we have that a particular project will actually keep the carbon out of the atmosphere for a given period of time.

To truly understand permanence, we need to think in geological time, not human time. The carbon released out of your car today will remain in the atmosphere for anywhere between 300 and 1,000 years.

So when we talk about permanence, we need to think beyond our own lifetimes. The best carbon offset projects assure that the carbon they sequester or avoid will remain out of the atmosphere for at least 100 years. Typically, 100 years is considered the benchmark that allows a project to brand itself as ‘permanent’. This is different to the scientific definition of permanence (until infinity), but is a more practical definition in the real-life setting of carbon offsetting projects.

Permanence vs. durability: a note on terminology

The term ‘permanence’ is sometimes used interchangeably with ‘durability’. Both terms are descriptions of specific aspects of carbon storage, but durability can refer to both the planned duration of storage (e.g. 25 years) or the risk of storage reversal before that time is up. On the other hand, permanence refers to the risk of storage reversal generally.

Durability is a more recent term in the world of carbon credits, largely due to the introduction of technology such as direct air capture and enhanced weathering. There is minimal reversal risk for carbon removal technology — the captured carbon can be stored for thousands of years with minimal risk of reversal. This means that technology-based solutions like direct air capture have durability, whereas nature-based solutions, like forestry projects, do not, and face a far higher risk of reversal.

Ultimately, when referring to the level of confidence in a project’s carbon storage lasting 100+ years or more, permanence is the preferred industry term.

How do carbon offsetting projects assure permanence?

This is the difficult part. Ensuring carbon credit permanence can almost feel like ensuring the impossible, because we don’t know what the future holds. How can we know for sure that the carbon from these projects will stay out of the atmosphere?

There are many scenarios that lead to the carbon removed by offsetting projects being released back into the atmosphere (a process also known as ‘reversal’), and these scenarios largely depend on the project type.

All carbon offsetting projects face the risk of reversal. For certain carbon projects, such as solar and wind farms, the risk of reversal is not quite so damaging, since a project being destroyed doesn't negate the benefits it previously provided (they just prevent future benefits). But for other projects — those that sequester carbon from the atmosphere and store it, whether in trees, soil, or artificially — that can experience a more damaging reversal, since anything that physically disrupts the project can lead to the stored carbon being released, undoing all the benefits the project has provided up until that point, while also preventing any future benefits.

Some reversals are avoidable (think: land being converted for other uses, or being over-harvested), while others are beyond human control (think: natural disasters and changing climates).

For example, forestry conservation projects (REDD+ projects) in hot, dry climates are at higher risk of wildfires. If a fire tears through a forestry project, the forest carbon stored in its trees and soil will be released.

Similarly, if a tropical forest is handed over to loggers, or if a disease or plague of insects takes over, or a carbon capture and storage project fails to adequately meet its carbon storage commitments for the time period promised, each of these scenarios would lead to the carbon being released.

For nature-based projects in particular, there is a possibility for carbon reversal — particularly as climate change causes an increase in flooding, droughts, wildfires, and disease around the world. In the face of such uncertainty, how do carbon registries and carbon rating agencies like Sylvera ensure that nature-based carbon offsetting projects offer the degree of permanence that they claim to?

Carbon offsetting insurance

Most people aren’t aware that there’s a mechanism at work behind the scenes of carbon offset programs, and it’s designed to ensure permanence. Here’s how it works: to ensure permanence, carbon projects essentially insure against permanence, by ‘allocating’ a certain number of credits to a central ‘buffer pool’ of carbon credits. For example, if a carbon offset project claims to remove 50,000 tons of carbon per year, the project might donate 5,000 of those tons to the pool, making them unavailable for trading on voluntary carbon markets.

Think of it this way: an afforestation project manager might section off an extra piece of land whose credits can be given to the insurance pool, and not made available to the people buying carbon credits.

This insurance payment creates a large shared pool of ‘spare’ carbon credits across the world, which protect participating projects against future worst-case scenarios. If a forestry project in Tanzania burns down, credits can be drawn from the pool — which might consist of credits from all over the world — to make up for the loss.

The number of credits a project issues to the insurance scheme depends on the level of risk the project assumes, much like regular insurance plans. Projects at higher risk of reversal will need to commit more credits to the scheme. Offset projects can also lower their insurance costs by taking certain actions to mitigate risk, such as implementing legally binding restrictions on how the land can be used, or conducting fuel treatments such as thinning, pruning, and mowing, to minimize the potential for fire damage.

Unfortunately, the rising instances of wildfires and natural disasters around the world mean that the current volume of credits going to the industry’s insurance plans might not suffice to cover the damage in years to come. As the voluntary carbon markets grow, we’re likely to see more steps taken to assure the permanence of carbon offsets. For example, insurance broker Aon recently partnered with Revalue Nature, a nature-based carbon project financier, to help to reduce risks around project permanence.

How can I make sure the carbon credits I’m buying are truly permanent?

While it’s impossible to be entirely certain about a given carbon project’s permanence, there are questions you can ask, and steps you can take, to ensure your project offers a high degree of permanence.

Ask about risk management

The best carbon projects will have a proper plan for managing and mitigating the risks of carbon reversals (and actually follow it). Such plans might include:

- Thinning to reduce the risk of forest fires and diseases

- Best practice financial management to ensure the project doesn’t fail due to mismanagement of funds

- Measures such as easements or legal restrictions to ensure the land isn’t over-harvested or converted for other uses

Work with a trusted partner

Evaluating carbon project permanence is a difficult task, and often requires advanced data and techniques that most organizations don’t have the resources to conduct independently. Many companies look to partner with organizations they can trust to verify the quality of the carbon credits they’re considering to offset their greenhouse gas emissions.

At Sylvera, when assessing the permanence of carbon projects, we consider a multitude of factors including natural risks and people-related risks. We also look at historic exposure to natural risks such as fires, droughts, floods, pests, and hurricanes and evaluate trends and patterns. Our team also forecasts natural risks with our in-house climate risk models and simulations. For people-related risks, we consider land tenure rights, carbon credit issuance rights, free, prior and informed consent (FPIC) of indigenous populations, as well as, the project proponent’s access to capital and geopolitical risk factors.

To provide organizations with the full view of a carbon project, we evaluate the likelihood and severity of a variety of risk factors individually, before combining this into an overall risk score, which enables investment in high-quality offsets. Want to know more? Request a demo today.

.png)

.png)